Understanding your payslip

Each pay period your employer provides you with a summary of what you have been paid. Understanding what all the different numbers and abbreviations mean can be confusing.

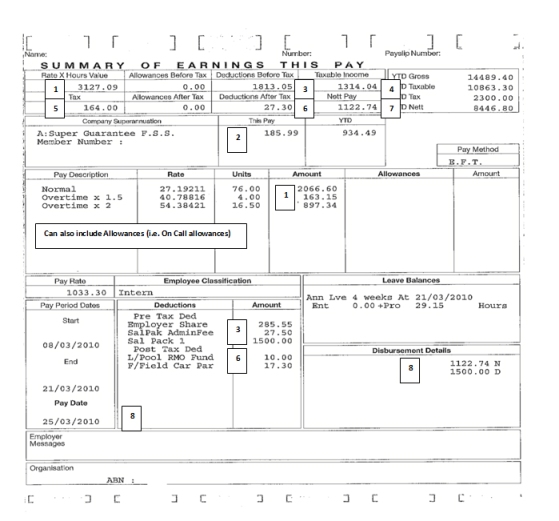

We have analysed a typical payslip to explain the components. Please refer to the image of the payslip and follow the numbers.

- This figure represents the Gross income for the pay period. It is calculated by multiplying the hours worked by the pay rate for the hours involved. It can include Ordinary Times Earnings, Overtime at the applicable loading, and allowances such as “On call” allowances. In this example, Ordinary Times Earnings are paid at the rate of $27.19211 per hour for 76 hours ($2066.60). In addition, four hours of overtime was paid at “time and a half” and two hours at “double time”, therefore, the total overtime paid was $1060.49, and the Gross Income for the period, $3127.09.

- Your employer is required to contribute 9% of your Ordinary Times Earnings to superannuation. In this case, 9% of $2066.60, which is $185.99, was paid to First State Super, the superannuation account in this example. Next to this box is another that shows what superannuation has been paid for the financial year to date.

- If you are salary sacrificing part of your salary, the amounts sacrificed will show here. In this example, $1500 is sacrificed in each pay period. The employer charges an administration fee of $27.50 and also withholds half the tax saving on your salary sacrifice arrangement, which in this example is $285.55. A total of $1813.05 has been deducted from the pay before tax is applied.

- This shows the taxable income, which is this case is $1314.04. That is, Gross Income of $3127.09 at Item 1 less Deductions before tax of $1813.05 at Item 3.

- Pay As You Go (PAYG) tax is withheld from the taxable income and is based on the marginal tax rate at the time the salary is paid. The employer sends this money to the Tax Office on your behalf.

- Any deductions that have been withheld from your after-tax income will appear here. In this case, $10 has been taken out for an RMO fund and $17.30 for parking fees. The total of these amounts withheld will be shown on your PAYG

summary at the end of the year and may be represent a tax deduction. Check this with your Bongiorno adviser. - The Net Pay is your taxable income less tax withheld, less after-tax deductions. In this example it is $1122.74.

- This shows the date on which payment was made to your bank account and the amounts that were paid. In this example, payments of $1122.74 and $1500 were paid into the employee’s account on March 25, 2010.

At the top right of the payslip is a box that shows the Gross Income, Taxable Income, Tax Withheld and Net Pay for the financial year to date. Further down on the right-hand side is a box showing your accumulated annual leave at the date of payment. At the bottom left is a box showing the period covered by this particular pay and, as mentioned above, the date on which payment was made.

In our next newsletter, we will analyse how to read a superannuation statement.