The investment law of averages

The optimum time to invest in shares or units in a managed fund is when prices are at their lowest point, but this is very difficult to determine. By spreading your investment contributions out, you can take advantage of favourable unit or share prices, and reduce your exposure to less favourable prices. This is called Dollar Cost Averaging.

The key to effective Dollar Cost Averaging involves investing smaller amounts at regular intervals so that you purchase fewer shares or units when market prices are high, and more shares or units when the market prices are low.

By making monthly contributions at different prices, you’re minimising the risk of making a single contribution at the wrong time, which can have a detrimental impact on your portfolio.

Similarly, small amounts are often not missed from a monthly household budget, yet have a surprising way of adding up.

A further advantage to a DCA strategy is that it effectively smooths a path through a volatile investment market – such as the one we’re currently experiencing.

Case study

Mrs James invested $1,000 in the Market Leaders Equity Fund (MLEF) on 31 January. Her Bongiorno adviser analysed her budget, and consequently recommended an additional monthly contribution of $1,000. The total came to $12,000 over the course of the year.

Because the unit price of the MLEF fluctuated, Mrs James could take advantage of lower prices and avoid the adverse effects of higher ones. The table below shows the regular contributions made and the number of units purchased each month.

| Investment | Date | Unit price | Units Purchased |

| $1,000.00 | January | $2.00 | 500.0000 |

| $1,000.00 | February | $2.20 | 454.5455 |

| $1,000.00 | March | $2.00 | 500.0000 |

| $1,000.00 | April | $2.40 | 416.6667 |

| $1,000.00 | May | $1.20 | 833.3333 |

| $1,000.00 | June | $1.40 | 714.2857 |

| $1,000.00 | July | $1.50 | 666.6667 |

| $1,000.00 | August | $2.40 | 416.6667 |

| $1,000.00 | September | $3.00 | 333.3333 |

| $1,000.00 | October | $2.60 | 384.6154 |

| $1,000.00 | November | $2.80 | 357.1429 |

| $1,000.00 | December | $2.60 | 384.6154 |

Total Investment |

$12,000.00 | ||

Total Units at @ Average $2.01 |

5,961.8715 | ||

Investment Balance at 31 December |

$15,500.87 | ||

Dollar Cost Averaging can be an effective approach for people looking to build their investments, but as with any strategy, there’s no guaranteed return. In our experience, Bongiorno clients have achieved better results by following a DCA plan, particularly in uncertain economic times.

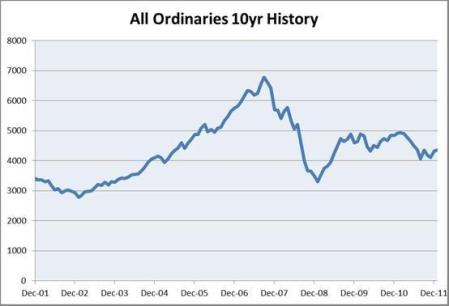

The Australian Share market, represented by the All Ordinaries Index peaked in October 2007 at approximately 6,800 and troughed in March 2009 at approximately 3,100. The All Ordinaries is currently trading at approximately 4,300.

Over a long term, at least 7–10 years, there are opportunities in following a DCA plan.

For further information about Dollar Cost Averaging and how it might work for you, talk to your Bongiorno adviser.

As this general advice has been prepared without taking account of your objectives, financial situation or needs, you should consider the appropriateness of this advice before acting on it. If this general advice relates to acquiring a financial product, you should obtain a Product Disclosure Statement before deciding to acquire the product.

Sources:

www.retireplan.about.com The advantages of dollar cost averaging (Jan 2012)