Budget Summary

The government announced the 2020-2021 budget on 6 October 2020 with a series of proposed measures. We have been monitoring these measures and their passing of legislation and the key changes relevant to you.

The 2020 Federal Budget is an economic recovery plan for Australia. The focus right now is on the path to growth and stabilising debt in an effort to boost consumer and business confidence.

1. Personal Income Tax Cuts (Passed through legislation)

The government has brought forward its planned income tax cuts by two years. The tax cuts will come into effect from 1 July 2020. Employers have until 16 November 2020 to implement the new tax table.

The changes are

-

Low Income tax offset increase from $445 to $700

-

The 19% tax bracket will increase from $37,000 to $45,000

-

The 32.5% tax bracket will increase from $90,000 to $120,000

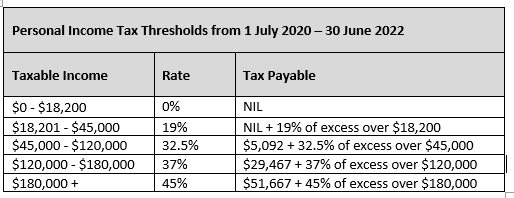

Marginal Tax Rates for 2021 FY

Additional 2% medicare levy to be added

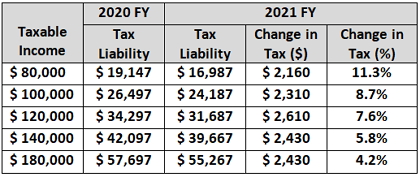

Tax Relief by Taxable Income

Includes 2% medicare levy

2. Temporary full expensing of eligible capital asset (Passed through legislation)

The Government will amend the tax law so that businesses with aggregated annual turnover of less than $5 billion will be entitled to deduct the full cost of eligible capital assets in the year they are first used.

Full expensing in the year of first use will apply to:

-

new depreciating assets

-

the cost of improvements to existing eligible assets;

-

for small and medium businesses (aggregated turnover of less than $50 million) — second-hand assets.

Applies to eligible capital assets acquired from 7.30pm AEDT on 6 October 2020 and first used or installed by 30 June 2022.

3. Instant Asset Write off extension (Passed through legislation)

Eligible businesses that acquire eligible new or second-hand assets under the $150,000 instant asset write-off by 31 December 2020 will have an extra six months, until 30 June 2021, to first use or install those assets.

4. Capital Gains Tax removed from ‘granny flats’ (still subject to legislation passing)

The Treasurer announced the Government will amend the tax law to provide a CGT exemption for granny flat arrangements where there is a formal written agreement.

Under the measure, CGT will not apply to the creation, variation or termination of a formal written granny flat arrangement providing accommodation for older Australians or people with disabilities.

The change will only apply to agreements entered into because of family relationships or other personal ties and will not apply to commercial rental arrangements.

The date of effect will be from 1 July 2021.

5. Superannuation Reform (still subject to legislation passing)

The Government has announced it will implement reforms to superannuation to improve outcomes for members by:

- Ensuring superannuation follows employees when they change jobs.

An existing superannuation account will be ‘stapled’ to a member to avoid the creation of a new account when that person changes their employment.

- Empowering members

The ATO will develop an online, interactive comparison tool (‘YourSuper’) to help employees decide which superannuation product best meets their needs. It is intended the tool will:

- provide a table of simple superannuation products (MySuper) ranked by fees and investment returns;

- link members to superannuation fund websites where they can choose a MySuper product;

- show members their current superannuation accounts and prompt them to consider consolidating accounts where they may have more than one.

- Holding Superannuation Funds to account for underperformance.

From 1 July 2021, the Australian Prudential Regulation Authority (APRA) will conduct annual tests on the net investment performance of MySuper products. Products that have underperformed over two consecutive annual tests will be prohibited from receiving new members until a further annual test shows they are no longer underperforming.

By 1 July 2022, annual performance tests will be extended to other superannuation products.

- Increasing accountability and transparency

Ensuring superannuation trustees are more accountable and transparent as to how they are managing the retirement savings of their members.

Proposed to commence from 1 July 2021.

If you have any questions, please contact your Bongiorno adviser.