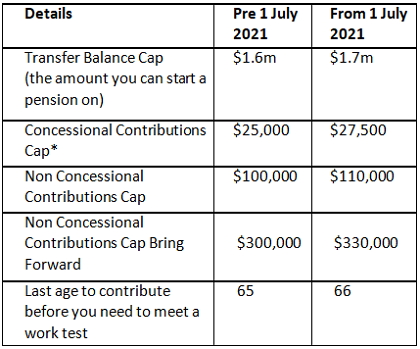

New Super Concessional and Non Concessional Contribution caps

Following the release of the Average Weekly Ordinary Times Earnings figure on 25 February 2021, super caps have been lifted. This is very exciting news because this is the first uplift since the current rules were introduced on 1 July 2017.

* These are pre-tax super contributions (they include employer’s Superannuation Guarantee (SG) and (including salary-sacrifice), some life insurance premiums within a super account, and personal contributions for which you choose to claim a tax deduction.

Proportional indexation applies, which means that if you have started a pension prior to 1 July 2021, you will not be entitled to add another $100,000 to your pension balance. Instead, you will apply the proportion of the unused amount to the $100,000.

Double deduction strategies

A strategy sometimes employed by those who need a large tax deduction in one year but not the next is the “double deduction” strategy. This strategy is carried out as follows:

-

contributions up to the concessional contributions cap are made during the 2021 Financial Year;

-

an additional contribution is made in June 2021; and

-

a personal tax deduction is claimed for two years’ worth of contributions in a 2020/2021

The second contribution in June 2021 can be $27,500. This is because it is being tested against the 2021/22 concessional contributions cap – and by then, the cap will be $27,500.